Table of Contents

- How the Bond Market Works - YouTube

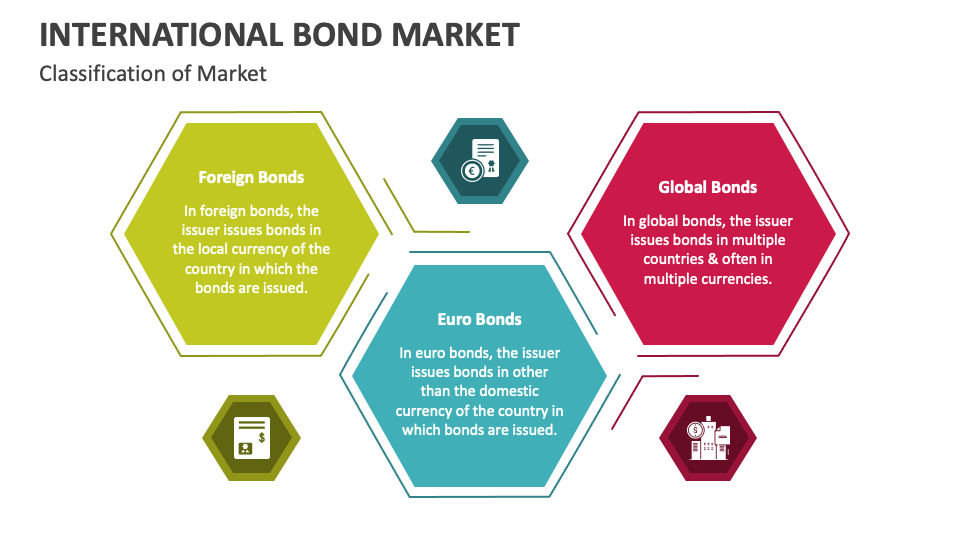

- International Bond Market PowerPoint and Google Slides Template - PPT ...

- What Investors Should Know About Bonds | Investing | US News

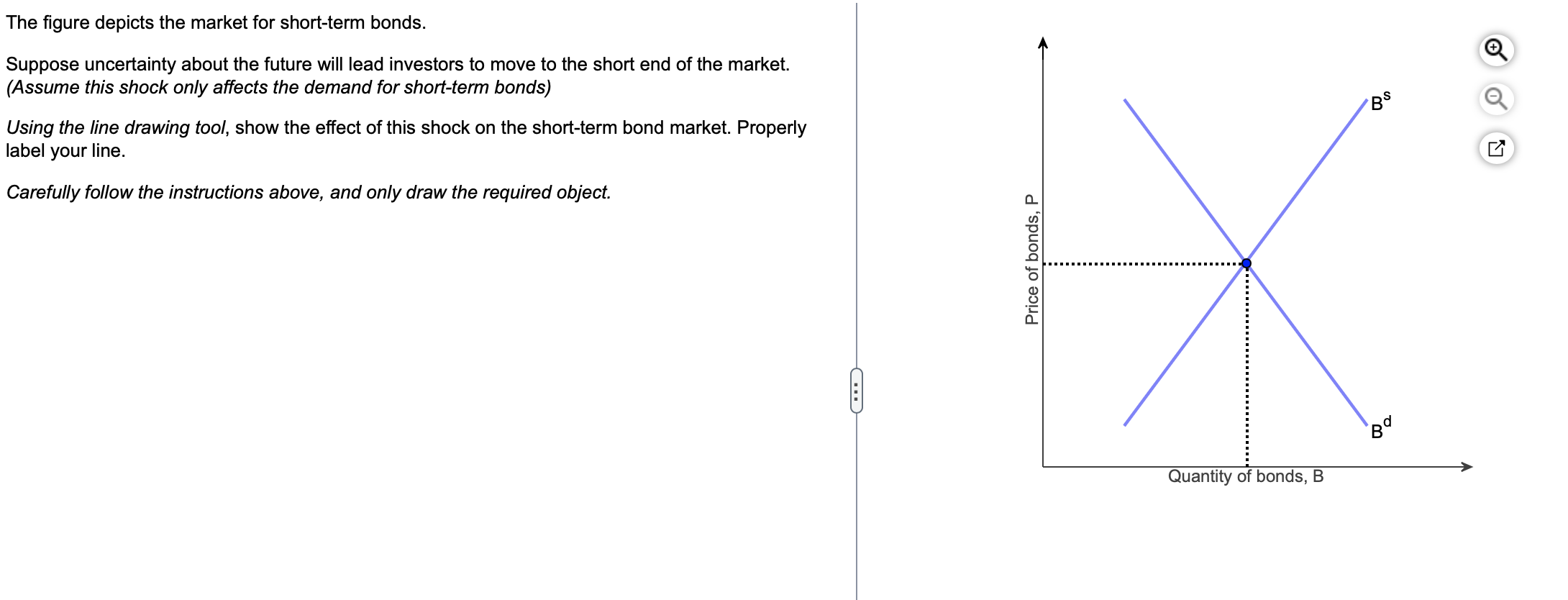

- Solved The figure depicts the market for short-term bonds. | Chegg.com

- How the Bond Market Works - YouTube

- How the Bond Market Works - YouTube

- Bond Market stock image. Image of income, fixed, bond - 65127667

- How does the bond market relate to the stock market? - Capitalinvestopedia

- An overview of the bond market and how to invest - Ocblog

- What Investors Should Know About Bonds | Investing | US News

Interest Rates and Inflation

Market Performance

Key Trends

- Sustainability and ESG: There's a growing trend towards sustainable and ESG (Environmental, Social, and Governance) investing in the bond market. Investors are increasingly considering the environmental and social impact of their investments, alongside financial returns. Schwab Funds offers options that cater to this trend, such as the Schwab ESG U.S. Broad Market ETF, which tracks an index of U.S. stocks that meet specific ESG criteria. - Technology and Bond Trading: Advances in technology are making bond trading more accessible and efficient. Platforms like Schwab offer sophisticated tools for bond investors, enabling them to make informed decisions and execute trades with ease.

Opportunities and Challenges

As we look ahead to the rest of 2025, there are both opportunities and challenges in the bond market. The potential for further economic slowdown or geopolitical tensions could lead to increased volatility, making it essential for investors to be strategic in their bond investments. On the other hand, the current yield environment presents opportunities for investors to lock in attractive yields, especially in the high-yield and international bond markets. The bond market in April 2025 is characterized by a delicate balance between interest rates, inflation, and economic growth. As investors navigate this complex environment, it's crucial to stay informed and adapt investment strategies accordingly. Schwab Funds offers a range of bond funds and ETFs that can help investors achieve their financial goals, whether they're seeking income, capital preservation, or diversification. By understanding the current trends and insights in the bond market, investors can make more informed decisions and potentially capitalize on the opportunities that arise. For more information on how to navigate the bond market with Schwab Funds, visit Schwab.com or consult with a financial advisor. Remember, a well-diversified investment portfolio that includes bonds can provide a stable foundation for long-term financial success.Disclaimer: The information provided is for general informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.